You can’t be unhappy in the middle of a big, beautiful river. – Jim Harrison

Believe it or not, the market is more than just the large-cap S&P 500. While it’s clear for over a decade that momentum has primarily been focused on large-cap tech names, one shouldn’t ignore mid-cap companies which could be on the growth trajectory to one day being larger. The question of course is when to do it. I personally believe the era of large-cap outperformance is nearing its end. If I’m right, mid-cap stocks can certainly be new cycle leader. That’s why the iShares Russell Mid-Cap ETF (NYSEARCA:IWR) is worth keeping on a watch list for a core allocation. Just not yet, given on-going relative performance weakness against SPY.

stockcharts.com

Launched on July 17, 2001, the iShares Russell Mid-Cap ETF offers exposure to mid-cap U.S. companies. With net assets of over $25 billion, this is one of the largest players tracking mid-sized stocks. The fund is based on the Russell MidCap Index. The ETF has 814 holdings, and on average is considerably better valued than large-caps with a price to earnings ratio of just 15.62.

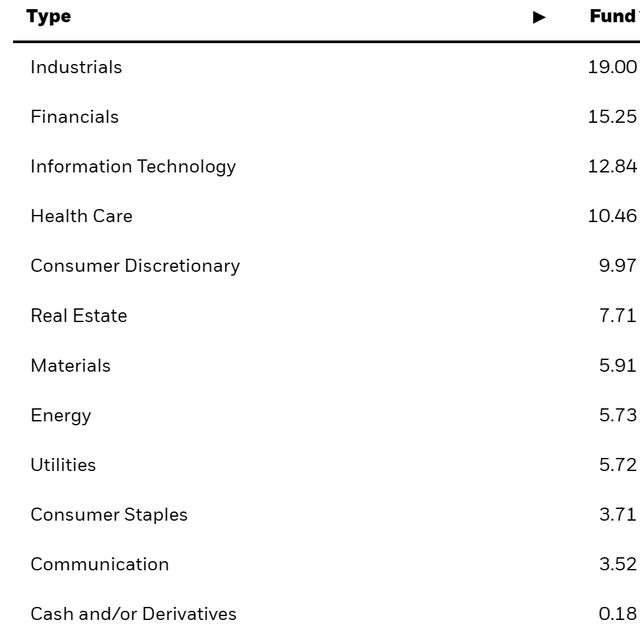

Sector Allocation & Holdings

From a sector perspective, the real big difference between large-caps and mid-caps is Technology. In the case of IWR, the largest sector representation is Industrials followed by Financials. Tech makes up just 12% of the fund – a far cry from what you see in headline market averages like the S&P 500.

ishares.com

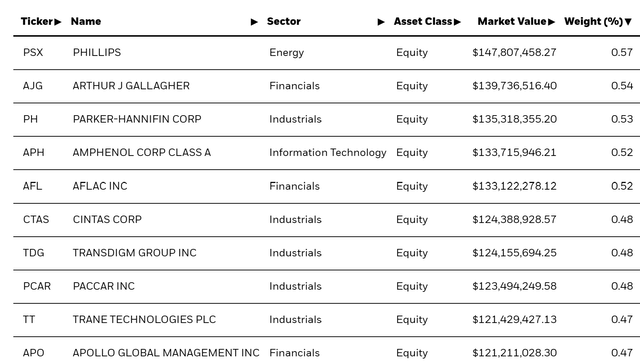

The iShares Russell Mid-Cap ETF’s holdings span numerous industries, offering investors the advantage of significant diversification, with no single holding making up more than 0.6% of the portfolio.

ishares.com

Peer Comparison

When compared to similar ETFs, the iShares Russell Mid-Cap ETF stands out. For instance, the iShares Core S&P MidCap ETF (IJH) and the Vanguard Mid Cap ETF (VO), track different indexes and therefore offer varying exposures. IJH, for example, has a higher focus on industrials, while VO’s holdings have a higher median market capitalization. In contrast, the iShares Russell Mid-Cap ETF offers a balanced portfolio, with a healthy mix of sectors and market caps. Moreover, unlike some of its peers, IWR has over $25 billion in assets under management, providing it with the liquidity and stability that many investors value.

The Case for iShares Russell Mid-Cap ETF

The argument for investing in the iShares Russell Mid-Cap ETF is strong, particularly as we see large-cap dominance potentially coming to an end. Mid-cap companies, often overlooked in favor of their larger counterparts, offer significant growth potential. They are typically at a growth stage where they have overcome the teething problems of small companies, but still have substantial growth opportunities ahead. As investors start to shift their focus from large-cap equities as I suspect they will, the iShares Russell Mid-Cap ETF offers a compelling investment opportunity. By investing in this fund, you are not just betting on individual companies, but on the growth potential of the mid-cap sector as a whole.

The bottom line here is simple. If you are bearish on Tech, you are bearish on large-cap. If you are bullish on stocks overall, then you likely should be more bullish on mid-caps. The iShares Russell Mid-Cap ETF is a good fund for what it does, and while it has underperformed large-caps the last decade, the next decade likely looks very different.

Markets aren’t as efficient as conventional wisdom would have you believe. Gaps often appear between market signals and investor reactions that help give an indication of whether we are in a “risk-on” or “risk-off” environment.

The Lead-Lag Report can give you an edge in reading the market so you can make asset allocation decisions based on award winning research. I’ll give you the signals–it’s up to you to decide whether to go on offense (i.e., add exposure to risky assets such as stocks when risk is “on”) or play defense (i.e., lean toward more conservative assets such as bonds/cash when risk is “off”).

Read the full article here