By Michael Kagan & Stephen Rigo, CFA

Backdrop for Risk Assets Is Positive

Market Overview

The S&P 500 Index (SPX)(SP500) continued its upward grind, rising 8% in the third quarter and advancing 15% year to date. The S&P 500’s strength is even more impressive given the index is up 34% since the April 8 post-Liberation Day low, at which point it was down 15% for the year. Clearly, tariff turmoil is in the rearview mirror for investors, while the AI economy powers ahead.

Benchmark performance remains highly concentrated: only three of 11 GICS sectors outperformed the index in the quarter, with technology — AI in particular — the principal driver. Leadership mostly mirrored the second quarter’s. Information technology (IT) led all sectors, up 13%, followed by communication services at 12% (these two led second-quarter performance as well). Within IT, tech hardware gained 23% as AI-driven storage demand lifted memory players while Apple shares performed well on expectations for an iPhone 17 upgrade cycle. The AI-themed semiconductor industry advanced 18%, building on a 43% return in the second quarter; the semiconductor industry is now up 39% year to date after declining 18% in the first 90 days of the year.

Consumer staples was the worst performer overall and the only sector to decline in the quarter. Weakness was broad based amid soft demand, worries about an influx of cheaper goods from China and limited pricing power to offset rising costs. Underperformance in materials, financials and industrials appears tied to persistent malaise in the traditional economy, as investors grow impatient with the still-elusive reshoring-driven boost to output.

After a bumpy start to 2025, U.S. equities are poised for a third straight year of outsize returns. The S&P 500 is within reach of delivering 20%+ gains in three consecutive calendar years (2023 up 26%, 2024 up 25%, year-to-date 2025 up 15%) — a feat achieved only once in the past century (1995-98 delivered four straight years above 20%, with 1999 close at +19.5%). Given the euphoria around AI and scorching stock prices, it’s all too easy to draw parallels to the late 1990s froth.

As long-term investors, we’re at a crossroads. On one hand, the backdrop for stocks remains constructive: the Fed has begun easing rates; the yield curve is positively sloped with short rates anchored; credit spreads are tight; and capital markets are wide open. On the other hand, speculative risks are building alongside untenable valuations. The current AI land grab carries an “if you build it, they will come” mindset despite a lack of profitable AI applications today. Until recently the data centers were funded by the large tech companies from ongoing cash flows. This shifted in September 2025 when several large vendor-supported AI megaprojects were announced in partnership with cash burning, profitless enterprises. That circularity — where vendors or capital markets are needed to fund buildouts — poses risk, especially given the blue-sky forecasts used to justify the spend.

“Given the euphoria around AI and scorching stock prices, it’s all too easy to draw parallels to the late 1990s froth.”

It is too early to call a bubble, in our view, but the current environment is reminiscent of the Internet craze in 1998 or 1999. Extreme valuation disparities are beginning to appear between AI-related and unrelated companies just as they did between technology-related and unrelated companies in the late 1990s. The consumer staples sector appears to offer buying opportunities in terrific franchises at reasonable valuations.

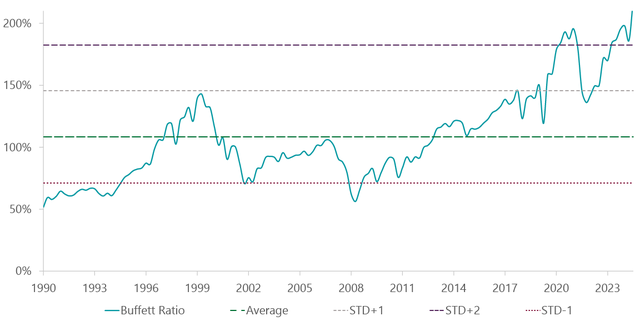

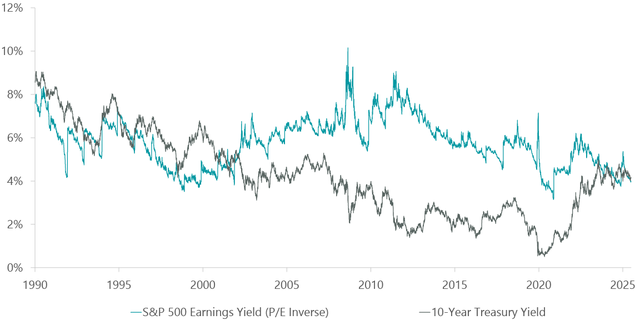

Valuation alone is rarely a reason to sell, but by several measures equities have never been more expensive. For example, the Buffett Ratio, which measures total equity market cap to GDP, stands at 219%, its highest reading ever (dating back to 1990) and over two standard deviations from the long-term average (Exhibit 1). To us, this implies an equity market already discounting a sizable share of AI’s hoped-for GDP and corporate profit gains, with little cushion for delays or disappointments. We would also note that the Fed Model — which compares the 10-year Treasury yield relative to the S&P 500 earnings yield (earnings yield is simply the inverse of the P/E ratio) — is in equilibrium, a setup rarely seen since 2002 (Exhibit 2). Put simply, today’s risk-free rate is a far more competitive alternative relative to risk assets than at almost any time over the past 25 years.

Exhibit 1: Buffet Ratio at Extremes

As of Sept. 30, 2025. Source: ClearBridge Investments, Bloomberg Finance.

Exhibit 2: Risk-Free Rate Competitive with Risk Assets

As of Sept. 30, 2025. Source: ClearBridge Investments, Bloomberg Finance.

Outlook

As in the second quarter, policy remains supportive of near-term growth, and capital markets conditions suggest risky assets such as stocks can continue to do well. That said, the market appears to be entering a more speculative phase, raising the risk of correction. In our view, capital markets will determine whether equities can sustain their advance. If investors keep rewarding AI megaprojects with higher share prices the cycle can persist. But if markets tire of new multiyear infrastructure commitments or funding AI firms at ever-richer valuations, there is little valuation support to fall back on.

We are long-term investors focused on through-the-cycle outperformance via downside protection, and we increasingly believe risks may be starting to outweigh the potential rewards. Accordingly, we keep a close eye on balance sheet and cash flow durability across our holdings to ensure our exposure centers on companies with the financial wherewithal to weather a potential cooling in today’s white-hot environment.

Portfolio Highlights

The ClearBridge Appreciation ESG Strategy underperformed the benchmark S&P 500 Index in the third quarter. On an absolute basis, the Strategy had gains in seven of 11 sectors. The IT and communication services sectors were the main positive contributors to performance, while the consumer staples and industrials sectors were the main detractors.

In relative terms, overall stock selection and sector allocation detracted. Stock selection in the industrials, communication services, IT and consumer staples sectors detracted the most, along with a consumer staples overweight and an IT underweight. Conversely, stock selection in and an underweight to the health care sector and a communication services overweight proved beneficial.

On an individual stock basis, the biggest contributors to relative performance during the quarter were TJX (TJX), ASML (ASML), Vulcan Materials (VMC), Alphabet (GOOG) and not holding Salesforce (CRM). The biggest detractors were Costco (COST), Synopsys (SNPS), Apple (AAPL), Netflix (NFLX) and Honeywell International (HON).

During the quarter, we initiated new positions in Marsh & McLennan (MMC) in the financials sector, Lennar (LEN) in the consumer discretionary sector and International Paper (IP) in the materials sector. We exited Starbucks (SBUX) in the consumer discretionary sector, Old Dominion Freight Line (ODFL) in the industrials sector, Progressive (PGR) in the financials sector, Crown Holdings (CCK) in the materials sector and Synopsys in the IT sector.

ESG Highlights: Innovating Carbon Capture Across Industries

While deployment of renewable energy sources such as solar, wind and hydro will likely play the largest role in the energy transition, carbon capture and sequestration (CCS) remains an important technology for heavy industries that produce unavoidable CO2 emissions.

There are many types of CCS, and ClearBridge holdings with which we engage regularly represent a diverse portfolio of CCS technologies. Recent engagements with portfolio companies have touched on ways they are developing CCS across several industries and how in most cases CCS capabilities are driving share gains and improving cash flows.

Cleaner Hydrogen Technologies Advancing in Manufacturing

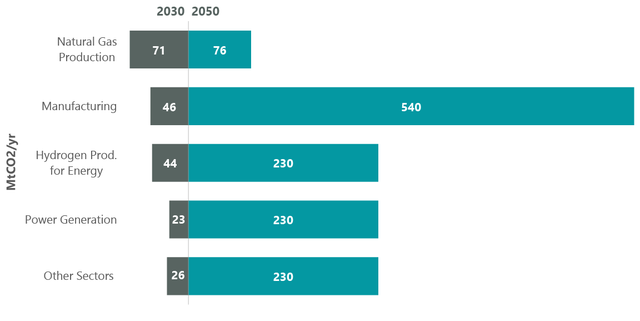

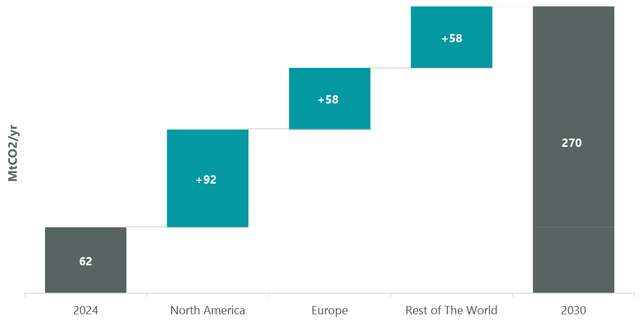

CCS is critical in addressing emissions from manufacturing and will be all the more so as capacity additions ramp up globally in the coming years (Exhibits 3 and 4). In North America, the main applications are hydrogen and ammonia. These were focal points of recent ClearBridge discussions with industrial gas company Linde (LIN), which we find is well-positioned to continue taking share in clean hydrogen, specifically blue hydrogen. (Blue hydrogen is produced using fossil fuels but with carbon capture technology preventing emission of CO2, and is used for various industrial, energy and transport applications).

Exhibit 3: CCS by Sector 2030 and 2050

As of 2025. DNV, “Energy Transition Outlook CCS to 2050.”

Exhibit 4: CCS Capacity Additions to 2030

As of 2025. DNV, “Energy Transition Outlook CCS to 2050.”

ClearBridge recently toured Linde’s autothermal reformer (ATR) site at its Clear Lake facility in Texas, where Linde provides blue hydrogen and CO2 to support industrial chemicals supplier and manufacturer Celanese with its methanol and acetyl production.

An ATR is essentially a large chemical reactor that combines natural gas, oxygen and water/steam to produce synthesis gas or syngas (hydrogen plus carbon monoxide/dioxide), a critical input for applications like chemicals production (such as methanol, which is used for paint solvents, antifreeze, fuels, pharmaceutical laboratories and adhesives, among other things). Syngas is also used in power generation, ammonia and fertilizer production for growing crops, and refining (desulfurizing oil, which reduces sulfur dioxide emissions).

Linde’s ATR technology is especially attractive as it is more efficient than other methods of producing these inputs given its better energy efficiency, higher CO2 concentration for better carbon capture, higher product yield and lower maintenance.

Linde has been able to leverage the success of this technology as a proof point to win other projects that support clean hydrogen and ammonia production in the U.S. Other blue hydrogen deals, such as in Nederland, Texas (where Woodside/OCI creates blue ammonia for agriculture, power and marine sectors), in Alberta, Canada (where Dow produces blue hydrogen for ethylene production with two ATRs), and the latest in Modeste, Louisiana (where CF Industries runs a large-scale air separation unit to support blue ammonia).

Linde represents an excellent example of a company where technological expertise in a sustainability practice is driving both emissions savings and growth for the business. In 2024, Linde helped its customers to avoid more than 96 million metric tons of carbon dioxide equivalent, more than twice the emissions that Linde generated from its own operations.

What is Biogenic CO2?

Green Plains (GPRE), a U.S.-based agricultural technology and biorefining company based in Nebraska, is one of North America’s largest producers of ethanol and bio-based products. It serves several main industries, such as ethanol for fuel, agricultural services (grain management), high-protein feed for livestock and aquaculture and renewable corn oil.

ClearBridge recently met with Green Plains’s CFO and Director of Sustainability to discuss the company’s carbon capture initiatives and other developments that impact its carbon intensity (CI) and ability to meet its target of net-zero emissions by 2050. The company recently suspended its clean sugar technology (CST) and ultra-high protein (UHP) initiatives to focus on carbon capture, which is more cost-effective under current tax credit structures.

Green Plains considers carbon capture a key tactic in decarbonizing biorefineries by capturing the pure stream of biogenic CO2 from fermentation (CO2 is released from the fermentation process of biological materials such as plants used for biofuels). Initiatives include partnering with Tallgrass Energy on the Trailblazer carbon pipeline, which will initially serve three Green Plains facilities in Nebraska, and is expected to sequester 800k tons of CO2 annually beginning this year. These facilities are also expected to generate $150 million in 45Z tax credits (for clean fuel production).

In addition, running other plants in a similar fashion without carbon capture can net another $50 million under 45Z. Green Plains is raising capital for another deal with startup Carbon Solutions to perform carbon capture on other Midwestern plants. If the 45Z program isn’t extended after 2029, Green Plains would drop down to 45Q credits, which are worth one-third of 45Z, until that program ends in 2038.

Overall, however, these credits are valuable programs that get Green Plains past recent liquidity issues after years of capex on plant modernization. With roughly $50 million left in carbon capture capex, Green Plains has already cut its operating expenses by more than 50%, setting it up to generate ample free cash flow going forward.

Rocks Can Sequester Carbon

In a recent engagement with Vulcan Materials (VMC), the largest producer of construction aggregates such as crushed stone, sand and gravel in the U.S. and a name widely owned across ClearBridge, we checked in on Vulcan’s goal of 10% absolute reduction in Scope 1 and 2 emissions by 2030. Vulcan shared that its Scope 1 and 2 emissions profile declined by 3% in 2024 versus its 2022 baseline, an improvement on 2023’s flat performance. While 3% may seem low, aggregates production already carries a low GHG intensity, so the incremental progress is notable.

Key drivers were increasing renewable adoption (now 14% of total electricity versus a 5% stated goal), upgrades to engines with 20%–50% lower emissions and increased renewable diesel usage in California. Renewable diesel — produced from vegetable oils, waste oils and animal fats and, unlike biodiesel, a “drop-in” fuel that can be used directly in engines without blending or modifications — now accounts for 9% of Vulcan’s total diesel usage.

We also touched on Vulcan’s operational use of water to wash residue off rocks and to suppress dust. We were encouraged to hear water recycling takes place at roughly 75% of Vulcan’s sites and that the company is striving for further improvement.

Increasing water recycling is a win-win from both a sustainability and economic perspective. At the 25% of sites where there is no recycling, Vulcan purchases water and absorbs the cost of trucking it. This seems like an easy target for the company to address over time.

Another interesting facet of Vulcan’s environmental profile is that some of its basalt fines (i.e., dust byproduct of rock production) actually help sequester CO2. We learned the agricultural market can spread this byproduct on soil to support “enhanced rock weathering” whereby rainwater spurs a chemical reaction that traps atmospheric CO2 in newly formed, solid material. While sequestering CO2 with basalt fines is certainly not a core part of Vulcan’s business, it is nonetheless a positive attribute in its environmental profile.

Michael Kagan, Portfolio Manager

Stephen Rigo, CFA, Portfolio Manager

Original Post

Read the full article here